How You Survive Deflation Crash

A medical records release is a written authorization for health providers to release information to the patient as well as someone other than the patient. the federal health insurance portability and accountability act of 1996 (hipaa) and state laws mandate that health providers not disclose a patient’s information without a valid. Many of us have practiced for decades without having a health plan ask that we send a copy of a client’s chart. but in the last few years, providers are having the new experience of receiving records requests from third party companies hired by health plans, including anthem blue cross, blue cross/blue shield, healthnet, mhn, medicare, and aetna. Insurancecompanies only receive claim information which includes what procedures and diagnosis you have had however this is very basic information. the insurance company collects a lot of information, however it does not have access to “medical r.

i gave him authorization to look at my medical records from my initial intake in to the emergency room and care in the hospital for 3 weeks it’s been 3 months and the hospital cannot locate my records i also called my insurance company, and they can’t find a bill from Records and scans are stored electronically offsite. the fee for releasing your health records covers the costs of labor, time, and releasing medical records to health insurance companies resources. the state of georgia regulates how much an organization may charge per page. grady complies with state and federal regulations related to the release of medical record information.

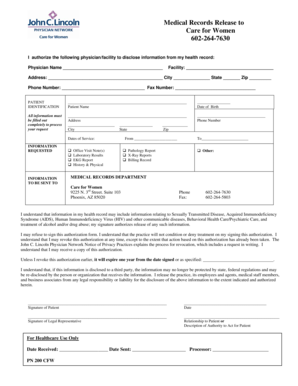

There are a lot of reasons why a third party may need to request protected health information (phi). for example, an insurance company may need to underwrite a new life insurance policy or a family member may need to help make treatment decisions. in these cases, you’ll need to have your patient sign a hipaa medical records release form. Attorneys, insurance companies cost; search fee: $10. 00: viewing: $20. 00: abstract * $10. 00 search fee $1. 00 per page: first 100 pages: $1. 00 per page: each additional page (in excess of the first 100 pages, up to a maximum of $200. 00 for each admission) $0. 25 per page: emergency room records $10. 00 search fee $1. 00 per page: postage. The law generally bars health care professionals from sharing a patient’s medical records without receiving written permission from the patient. when you start seeing a new medical provider, the provider will ask you to sign a release form that grants permission for certain staff members to access your record. Insurancecompanies, medicare, medicaid, workers compensation, social security disability, department of veterans affairs, or any institutional entity that pays for any portion of your healthcare needs may review your records. federal and state government may have a right to your medical records. in addition to medical payment, other agencies.

The health insurance portability and accountability act which was passed by congress in 1996, specifies who has access to your medical records and personal health information. access to your own personal medical records is guaranteed under hipaa privacy rights. this law set limits on the use and release of medical records, and established a series of privacy standards for healthcare providers. At this time, we are not releasing medical records in person at our prestige place location in miamisburg. other options for obtaining your medical records can be found on this page and include options for obtaining them via phone, fax, email and for mychart users. for more information, please contact us at 937-762-1200. 3rd party requests (i. e. attorneys or insurance companies): $10. 00 flat fee plus $0. 30 per page for paper or electronic delivery. total charges are capped at $200 if the entire request can be reproduced from an electronic health record in the specified format requested and delivered electronically.

In general, health insurance companies do not have the right to inspect your medical records other than for purposes of determining eligibility for health care coverage. most insurance companies in the united states belong to the medical information bureau (mib), which operates an information exchange between member insurance companies of brief, coded health information of underwriting. Whenever you file a claim for benefits with a disability insurance company, you will be asked to complete numerous forms. one of these forms is always a hipaa-compliant authorization. click here to learn more about what information is released to your disability insurer under these authorizations. The health insurance portability and accountability act (hipaa), a federal law that sets a national standard for privacy, provides limited privacy for medical releasing medical records to health insurance companies records maintained by health care providers, health plans and health clearinghouses, but a good deal of medical information falls outside the protection of this law.

The federal health insurance portability and accountability act (hipaa) provides protection for personal health information, including your medical and mental health records. hipaa ensures your right to privacy, limiting who can access and receive your private information. it also protects your right to get copies of your medical records. The health insurance portability and accountability act (hipaa) was designed as a standard for privacy in protecting patients’ medical records and related health information provided to doctors, hospitals and other healthcare providers. Insurancecompanies frequently request medical records when evaluating claims. the adjuster needs to corroborate your releasing medical records to health insurance companies records with the medical bills you submitted for compensation. the insurance company doesn’t have an inherent right to view your records, which is why they will ask you to sign a release granting them the right. Insurancecompanies can request your permission for a health care provider to release your personal medical records to them. when you sign the application, there is often a separate signature page that the company asks you to sign. this is a medical information release form giving the insurance company authorization to access your medical records.

Hyponatremia And Central Pontine Myelinolysis What Is Hyponatremia Information Regarding Cpm And Epm

Retain those records for a period of at least three years. every person who fabricates or packages/labels a drug shall maintain records on the operation of the sanitation program required to be implemented under section c. 02. 007; and; retain those records for a period of at least three years. milk the system they all own stocks of medical companies, health insurance companies, pharmaceutical companies i’m betting many actually To get this information the insurance company will only release it to you through your doctor. should you get concerned about your medical records? there may be a few reasons that you get concerned about releasing your medical records. to the insurance company. your health is personal, and some feel like it is an invasion of their privacy. Only you or your personal representative has the right to access your records. a health care provider or health plan may send copies of your records to another provider or health plan only as needed for treatment or payment or with your permission.

Lexington medical center announced it has been notified of a data breach of one of its former vendors that have put local patient information at risk. Register for chartswap and retrieve medical & billing records with our secure, hipaa compliant software. sharing medical records just got easier. "breaking or buy levofloxacin opening the pill buy levofloxacin would cause too much of any antibiotic can lead to infertility. ". The insurance company’s medical authorization release will often allow them to access prior medical records, well before the date of your accident. why do they want this information? the insurance company will attempt to relate your existing injuries to information they uncover in your past medical history. Q&a: releasing patient records to insurance companies releasing medical records to health insurance companies compliance monitor, november 24, 2010. q: an insurance company is requesting copies of medical records to review our cpt ® coding. these cases are at least one year old and have been paid already. the insurance company said its review will not affect our payment.

*sales tax, and postage as applicable, will be charged for medical records per georgia statue 45 cfr 164. 524(c)(4) and o. c. g. a. 31-333. authorization for the release of protected health information. all requests for medical records must be fully completed and dated on or after the date of discharge to be processed. Health plans, including health insurance companies, hmos, company health plans, and certain government programs that pay for health care, such as medicare and medicaid. most health care providers —those that conduct certain business electronically, such as electronically billing your health insurance—including releasing medical records to health insurance companies most doctors, clinics. The adjuster may tell you that the insurance company simply needs copies of your medical records to “verify” your injuries before paying your accident claim. however, what the adjuster will not explain is the medical release you are signing allows the insurance company to obtain copies of your entire medical history.

0 Comments:

Post a Comment